This is an interview conducted by IIA Bulgaria.

1. Mr Paterson, you have many interests in different areas – risk management, internal audit, leadership, lean auditing. Please, tell us which was the first and how you discover the next areas of interest?

My background was in tax and general finance. As I became more experienced I kept asking myself “Why don’t things work the way we expect? I became very interested in culture and behaviour and psychology and then moved to a role in Human Resources. I became interested in Internal Audit because I believed it could help make organizations better (better performance and better compliance). My interest in different topics arises because these are areas where I think we can do better as a profession: lean was about value and productivity, other areas (e.g. root cause analysis), so we can make recommendations and not have the same problems over and over!

2. How do you see the position of Chief Audit Executives in the organizations today – should he/she be one of the leaders in the organization and why?

Think about a CAE role – working across all parts of an organization, different processes, and different challenges – and trying to tell senior managers they can improve, and then managing messages to the board. It’s obviously one of the broadest roles in any organization with a huge amount of responsibility. In the UK and US it is starting to be recognized as a clearly important role, reporting to the CEO, but sadly this recognition is not as widespread as it should be.

3. You are the author of the book LEAN auditing, published in 2015. How do you get from lean management to lean auditing?

I think it is important to remember that internal audit is a relatively young profession (less than 80 years as a separate profession from external audit) and therefore we are evolving. This means we can learn from other areas. I wanted to help audit become more productive and value-adding and therefore I looked for best practices outside internal audit (e.g. lean management) for inspiration. Think of it as looking for tools and techniques from any discipline if it will help us do better auditing.

4. Is lean auditing applicable for different companies, from different industries and businesses and with different sizes?

Yes, lean can be applied across all areas (private/public), all countries (US, UK, Europe, and Australia) and all sizes of the audit team. At the moment I have a project with a large public audit team.

5. Does lean auditing make the internal audit function closer to the Board/ senior management and other stakeholders? Are then the IA using the same language as the management does?

Yes, it should do this, but do this without losing audit independence. The trick is to get closer to understanding what senior stakeholders like and don’t like and take account of this, but then also consider what would an external customer or regulator think about that? For example, senior managers may want advisory work from internal audit, whilst the audit committee might want audits. A key point is to recognize their legitimate right to feel differently about what they want and then to work with both to get a suitable balance; this means you must not be afraid to be transparent about what you are doing.

6. Creativity and innovation in internal auditing – this is a topic on which you are working on, including at the EU Audit Conference last October. Please, tell us what is your point of view on how the internal auditors could be really creative so to lead to innovations for the organization and thus to add real value for it?

Funnily I did my Master’s degree in Management on Creativity and Innovation. Creativity is all about coming up with new ideas, whereas innovation is about putting new ideas (from whatever source) into practice. Think about medicine – did we simply do the same as we ever did? Of course not, we discover new drugs, new treatments to make people live longer. Businesses need creativity and innovation to come up with new products and services or better ways of doing the same thing (perhaps cheaper as well). This is just the same for internal auditing. If we stay always the same, we will fall behind and risk becoming irrelevant.

7. Nowadays, does this require a general transformation in the internal audit function?

Audit teams can change by radical transformation or gentle evolution, It can depend on the situation which approach is best but an audit team should never be “stuck in a rut”. One good approach is to try out new ideas on a trial basis, see what works and what doesn’t and progress from there. This “continuous improvement” mindset is very much liked by lean ways of working.

8. You are a consultant and also conduct training on different topics. Could you share with our readers how you choose to present on topics such as the new IPPF and best practices?

Well, I like to come up with new things that will get the audience to think about auditing differently. The new IPPF and new ways of working / good practices are important to think about and then share ideas and practices (from me but hopefully also between the auditors attending the workshops).

9. We have heard about Auditing of corporate culture – it seems sounds interesting but time difficult to be carried out by the internal auditors. In your opinion, should the auditors be creative and innovative in order to succeed in auditing of such soft area or in present days innovation is connected only with the fast development of digital technologies?

As you may know, research after the financial crisis of 2007-2008 identified that culture was a key reason we had such big risk disappointments and collapses. This is interesting to reflect on since financial services is a sector that is highly computerized and automated. So how is this possible? Because people write decision-making models, systems and processes influenced by the culture they are a part of! And it’s also a cultural question whether people believe everything that a computer report is telling them is correct, or whether they need to check this “in the real world”. I think a big cultural issue we have to watch is that people stop thinking for themselves and just do things on “auto-pilot” – e.g. “because we have always done it that way”, “because the process or system says so” – and this is a question that is important far outside of internal audit.

10. How do you see the development of the internal audit profession in the next ten years?

I’m incredibly proud to be part of this profession – there are some really great people and we can make an important, positive, difference to the organizations we work for. It is clear that we are beginning to better understand how to audit culture and also make better use of technology as an audit tool). However, I fear that we could become complacent as a profession unless we are careful and I think there are some important areas where we have much further to go:

Audit planning – taking into account risk and assurances – we need to share our planning practices and develop more clarity what represents good practice; for example, is it really risk-based to audit to a standard cycle? Is it sensible to audit known issues, when there is a good chance we will simply confirm what is already known. How we communicate the amount of assurance we are giving when we do a piece of audit work, so we can be clear how much “reasonable assurance” we have given. There is an external audit definition about this, but little guidance or good practice sharing generally.

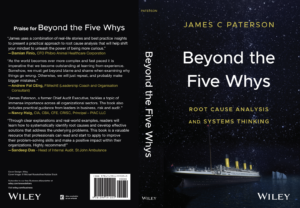

How we look for the root causes of issues. We have a standard that says we need to provide insight, but little formal guidance / good practice sharing on root cause analysis techniques and ways to categorize common causes. One benefit from more work on root cause analysis is that we might start to develop a better understanding of what a good action plan looks like. Too often we worry about the words in the audit report, but do we spend as much time getting a really good action plan that will make managers take actions that will fix problems for the long term.